The European FTTP industry: an investor perspective

November 2020

Introduction

The Fibre-to-the-Premise (FTTP) sector has been thriving in a number of European countries in the last five years, spurred by increasing data traffic. However Covid-19 struck in 2020. Corporate and finance investors are now trying to predict the future state of the industry.

This article answers the following questions:

Which European countries are leading the FTTP race?

What are the key Success Factors for FTTP rollout and take-up?

What has been the impact of Covid-19?

Where will investors find M&A opportunities beyond the pandemic?

What are the synergies between fibre and other digital infrastructure assets?

How should investors identify and assess potential targets?

2019 FTTB/H Penetration across Europe

(FTTB/H: Fibre to the Building/Home)

ADVANCED FTTP MARKETS

As shown in the above 2019 penetration chart of Fibre to the Building/Home (FTTB/H) from FTTH Council Europe, Europe has a wide range of FTTP markets displaying various levels of maturity.

In leading countries with high FTTP penetration rates (above 25%), such as Sweden, Spain, and France:

Government initiatives and regulation are favourable to both the incumbent and other providers.

Telecom operators co-invest in FTTP deployment and have opened their network to competitors.

Rural / non-commercial areas benefit from clear rules, subsidies, interest-free loans and tax incentives, and co-investment from municipalities and regional authorities.

Sweden

In Sweden, municipalities and utilities built local networks as early as 2000, and made them accessible to alternative internet service providers.

Spain

In Spain, Telefónica must offer its competitors wholesale access to its fibre network via a virtual unbundled local access (VULA) service, except in cities where three or more ISPs are already offering NGA services.

France

In France, the 2013 ‘Plan Très Haut Débit’ scheme defined three zones by types of deployment and financing and kickstarted investment in fibre with a €3.3 billion government contribution. In sparsely populated areas, local governments deploy FTTP using public funds.

Advanced versus immature markets: Spain and Germany examples

IMMATURE FTTP MARKETS

In markets with low FTTP penetration rates, such as Poland, Italy, Germany and the UK (and Greece):

NGN regulation is not comprehensive, for instance in Poland.

Alternative network operators, such as Open Fiber in Italy and Deutsche Glasfaser in Germany, have led FTTP investments.

Incumbents relying on copper (VDSL, G.Fast) and cable technologies (DOCSIS 3.0/3.1) had until recently hindered FTTP deployment. The charts above, which compare the German and the Spanish fixed broadband markets, illustrate this phenomenon.

Yet, recent government policy and investment (see the European National Broadband Plans displayed in the table further below) and regulatory changes could foster FTTP deployment in some of the lagging countries.

Germany

Germany is aiming for a nation-wide gigabit internet infrastructure by 2025. In November 2020 The European Commission approved the German scheme to support the deployment of Gigabit networks in areas where the private market does not provide them, with priority to the most under-supplied areas. This will be supported via a €10 billion to €12 billion investment fund.

Italy

In Italy, The merger between FiberCop, owned by TIM, and Open Fiber could accelerate the fibre rollout in Italy by preventing unnecessary duplication, as hoped by the Italian Government. On the other hand, it could distort competition – thus, the European antitrust authorities could block it – .

Poland

In Poland, the Megalaw was amended in 2019 in order to facilitate the implementation of the Broadband Cost Reduction Directive (BB CRD), including cheaper permits, better and more frequent use of the existing fibre and cable infrastructure, and new building access rules.

UK

In November 2020, the UK Government set a target of 85% gigabit capable coverage by 2025. The 2020 Spending Review allocated £1.2 billion between 2021-22 to 2024-25, out of the £5 billion investment plan to support full fibre rollout, which was announced in September 2019.

In December 2019, Ofcom’s Wholesale Local Access Market Review proposed a new regulatory approach to improve wholesale access to broadband networks and support investment in fibre. The consultation is ongoing. The new policies would take effect from April 2021 to 2026.

Greece

In Greece, the 2019 National Broadband Plan aims at closing the gap between remote and urban areas and is co-financed by public spending and EU funds.

European National Broadband Plans

KEY SUCCESS FACTORS FOR FTTP PENETRATION

The countries studied above indicate the key success factors for FTTP rollout and take-up. These include (but are not limited to) the following:

Clear and positive government policy and regulation

European Governments should put in place a stable and positive regulatory environment:

Set a long-term strategic vision

Define clear rules in non-commercial areas, and provide funding and tax incentives

Impose passive infrastructure sharing, ease fibre civils, and promote FTTP in new buildings

Promote new GPON technologies and retire PSTN copper as early as possible (Telia in Sweden and Telefónica in Spain are likely to complete copper decommissioning by 2024)

Pro-active corporate actions

Telecom service providers should implement pro-active FTTP initiatives:

Offer a full range of retail services and establish a strong omni channel experience

Monetise adjacent B2B services and tailor offering by sector

Select expansion areas based on revenue potential with detailed mapping ; connect directly to main content providers

Seek infra sharing opportunities with other operators and partnerships with infra funds

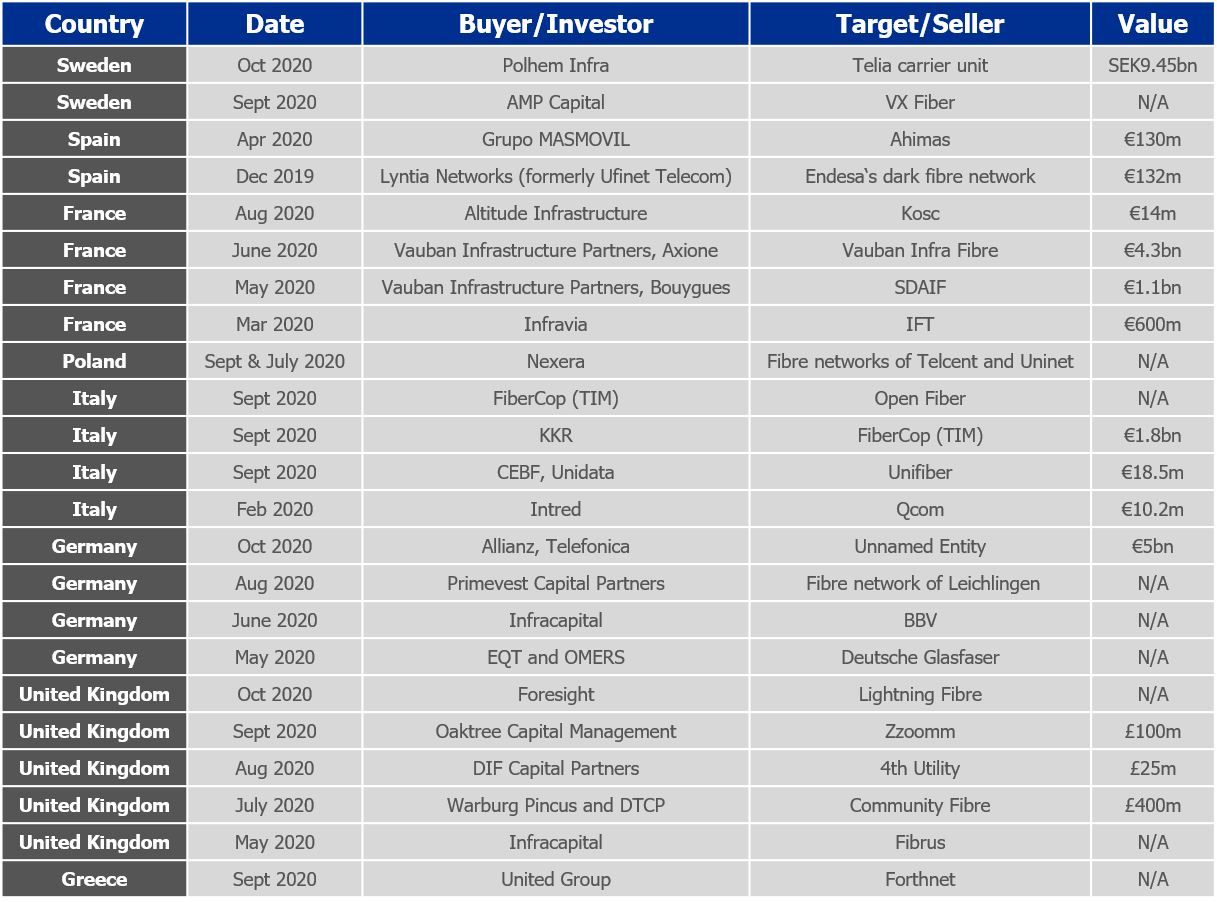

Significant European Fibre Deals During the Covid-19 Pandemic

IMPACT OF COVID-19

The 2020 European fibre deals listed above demonstrate that the fibre-optic investment fever is ongoing despite, or perhaps because of, the pandemic.

Covid-19 negatively impacts the FTTP rollout to some extent.

Lockdowns slow down FTTP deployment (e.g. entering the home to connect the router).

Besides, postponing 5G spectrum auctions could delay the deployment of fibre to the towers and reduce the synergies with FTTP.

However, fibre-optic has become as essential to societies as gas and electricity utilities.

The pandemic accelerates the digital transformation of corporations and societies as it demonstrates how essential and resilient this infrastructure is, even in the B2C market.

Some of this demand will continue beyond the pandemic as digital services and remote working get a foothold.

Furthermore, European stimulus packages will foster digitalisation and FTTP deployment:

The EU will dedicate 20% of its €750 billion Covid-19 NGEU recovery instrument (Next Generation EU) to ‘Single market, Innovation and Digital’ projects.

In September 2020, and as part of a €100 billion post-Covid-19 stimulus plan, the French Government committed €7 billion in digital investment, including an additional investment €240 million for its ‘Plan Très Haut Débit’, aimed at the rural fibre networks.

There is also a growth opportunity to bridge the social/digital divide that has become more evident during the pandemic. Yet the business case for rolling out FTTP in rural areas is challenging.

Projected New FTTB/H Subscribers from 2020 to 2026 (in millions)

INVESTMENT PREDICTIONS: GEOGRAPHIC MARKETS

Fibre investment and M&As will continue, driven by demand and Government policy. Trends will vary with the degree of maturity of the country. As can be seen in the diagram above, Germany, Poland and the UK feature amongst the most promising markets.

In countries with high FTTH penetration, investors will need to seek digital opportunities in niche markets. Consolidation of large telecom operators is also likely. In Spain for instance, the recent takeover of MÁSMÓVIL by a private equity consortium could presage consolidation in the telecom industry.

Opportunities for investment in independent FTTP players will present themselves in countries with low FTTP penetration where regulatory and competitive environment is becoming more favourable, especially in the UK and Germany, with large populations and economies, and in Poland where telcos are seeking to sell some of their infrastructure.

In September 2019, the UK Government announced £5 billion investment plan to support full fibre rollout ; in the summer of 2020, BT mentioned that they may sell a stake in Openreach in order to fund their £12 billion FTTP rollout.

In Germany, the federal regulator has a light approach to fibre last mile access ; Deutsche Telekom extended its infrastructure-sharing agreement with Telefónica to include FTTH in October 2020. DT will also open up fibre access networks to other competitors and will rollout more fibre.

Polish telecom players are seeking to sell some of their infrastructure in order to fund investments (Orange Polska, UPC, Cyfrowy Polsat and Play).

The French and Italian markets offer attractive growth, however their unique aspects could make organic expansion more challenging following an acquisition.

Although aimed at preventing unnecessary duplication of fibre rollout, the merger between FiberCop, owned by TIM, and Open Fiber could distort competition - thus, the European antitrust authorities could block it -.

The French fibre deals are becoming larger and more leverage. For instance, in April 2020, Bouygues Telecom and Vauban Infrastructure Partners created SDAIF, a Joint Venture (JV) which will invest over €1 billion to acquire access rights to Orange’s fibre networks in mid-dense areas and rent them to operators.

As well as investments, consolidations of independent networks will continue in countries with high FTTP growth potential.

In the UK, Cityfibre acquired FibreNation from Talk Talk in January 2020.

In Germany, in May 2020, EQT and OMERS jointly purchased fast-growing FTTP network provider Deutsche Glasfaser, which will be merged with Inexio.

In Spain, Ahimas purchased 6 further local fibre operators in 2020, following its acquisition of Alma Telecom in 2019.

In France, in December 2019, SFR FTTH, Altice’s subsidiary and the largest French fibre provider, acquired Covage, the fourth largest.

It will be mostly in-country consolidation initially, before moving on to European consolidation in the mid-term.

Finally, investors will also look for opportunities further afield geographically.

European FTTP Competitive Landscape

INVESTMENT PREDICTIONS: WHOLESALE BUSINESS MODEL

The attractiveness of wholesale players and the need to raise capital to fund further FTTP rollouts will bring further acquisitions and carveouts of open access entities, as well as wholesale agreements.

Telefonica and the PE arm of Allianz will create a fibre wholesale operator and will invest € 5 billion in this 50/50 JV.

In September 2020, Connecting Europe Broadband Fund (CEBF) and Unidata created a JV, and open-access FTTP network for residential and business users in the Lazio region.

Polish telecom players are seeking to sell some of their infrastructure in order to fund investments (Orange Polska, UPC, Cyfrowy Polsat and Play).

Whilst wholesale targets are ideal (less risk, lower operational costs), large opportunities are becoming fewer as the most obvious open access platforms have already been built in major countries.

Also, it is it is hard to start off in wholesale as this business proposition requires scaled rollouts (homes passed), operations and systems in order to attract large telecom clients.

Thus, investors probably need to invest in FTTP operators who have retail operations and can therefore build revenues and some credibility before becoming a wholesale operator and sharing potential customers.

Some retail operators will fail and some others will get acquired during the consolidation phase. Thus, targets must be carefully selected (e.g. strong demand, client commitments, no VDSL/cable incumbent in the fooprint, attractive business model and customer value proposition, deployment track record, and sound capex forecast).

INVESTMENT PREDICTIONS: RURAL AREAS

Outside of cities, it is unlikely that non-incumbents will want to overbuild each other, so being “first to dig” in targeted towns or villages is critical for an investment in FTTP (also avoids competing with renown ISP brands).

Speed, project coordination, stakeholder engagement with local authorities, and standardised execution are key.

It is “competition for the local market” and not “competition in the local market”, unlike past telecoms booms and crashes, e.g. international carriers (MCI, Worldcom, Global Crossing).

INVESTMENT PREDICTIONS: TELECOM CONSOLIDATION

Future fibre M&A activity is also likely to be a consequence of the mix of retrenchment and focus and expansion. For instance, Polhem Infra fund acquired the Carrier unit of Telia in 2020 and will seek further opportunities.

Further TMT convergence across Europe will impact the client landscape of fibre wholesale.

The EC referred the fixed-mobile merger between Virgin Media and O2 to the CMA in November 2020.

In Germany, regional fibre providers are concerned that the Vodafone / Unitymedia merger will throttle competition.

In September 2020, Polish mobile operator Play was acquired by Iliad, which will accelerate the development of its fixed services.

In February 2020, Vectra acquired Multimedia Polska and became the largest cable operator in Poland in subscriber number terms, overtaking Liberty Global’s UPC Polska.

FIBRE AND OTHER DIGITAL INFRASTRUCTURE

Investors should consider diversifying in other digital infrastructure assets and seek hybrid financing as valuation multiples rise.

Convergence of digital infrastructure assets

Fibre-optic has wider applications than FTTP. For instance, in February 2020, Bouygues Telecom and the Spanish operator Cellnex agreed to form a new entity, invest €1 billion until 2027, and develop a 31,500 km long fibre network serve towers and edge computing centres.

Collaboration across infrastructure businesses (e.g. towers, small cells, datacentres) is required and some level of convergence is expected.

Investors should share best practice and seek synergies across digital infra assets, but treat them as separate business models and rely on experts in each field.

Geographic diversification should also be considered.

Traditional vs. digital infrastructure assets

Digital infra assets can help investors edge against the seasonality and downturns of traditional infra assets (e.g. airports, toll roads).

Investors need to learn about the market and the various use cases in each digital infra asset class before embarking on their diversification.

Range of capital

It becomes challenging to enter digital infra markets on an attractive return.

Valuation multiples of digital infra assets have been sustained, or even increased, in 2020 versus 2019.

The Covid-19 pandemic has also created market volatility.

Besides, whilst Europeans telecom players have weak balance sheets, substantial investment is required to fund the planned growth of digital infra assets to support 5G, edge computing, etc.

Thus, more leverage is required and the debt capital market must evolve further and offer a wider range of financing.

Digital infra providers and investors should establish consortiums with like-minded institutions and banks and create a hybrid financing structure (involving, for instance, real estate lending leverage finance, and infrastructure debt).

Type of investors

With reducing rates of returns, the investors have evolved from PE firms to specialist infrastructure funds, then generalist infrastructure funds, and nowadays toward hedge funds, pension funds and insurance companies.

Further involvement of local authorities, municipalities and utility companies is to be expected in underserved areas.

Fibre Deal Assessment Framework

DEAL ASSESSMENT RECOMMENDATIONS FOR FIBRE INVESTORS

Investors should carefully select their fibre targets and assess potential synergies and further growth opportunities. As shown in the deal assessment framework above, this starts with the selection of the most attractive geographic markets.

Country Selection

Determine whether government policy and the local incumbent throttle competition or whether upcoming regulation and providers’ co-operation will foster it

Consider the government funding (e.g. public subsidies, tax incentives in rural areas) and assess national regulations (e.g. physical asset and dark fibre sharing, rights-of-way, dig once assets)

Gauge technology developments (e.g. retirement of copper and cable, promotion of XGS-GPON and NGPON2)

Identify the level of fragmentation and the consolidation stage of the national fibre industry (competitive landscape)Assess the market attractiveness (e.g. demographics, economics, fibre penetration, take-up rate) and demand drivers

Deal Scouting

Screen potential targets in selected geographic areas, based on such criteria as penetration

Be cautious of large valuations and assess the business model match between the acquirer and the target

Commercial Assessment

Gauge local addressable markets (e.g. nature of residential premises and private and public enterprises within the footprint, competition intensity, take-up incentives, wholesale vs retail tariffs)

Review the target’s past business performance and finance metrics, and identify any red flags

Assess its strengths in terms of product portfolio, pricing, service quality and density at national and regional levels

Review terms of contracts (e.g. anchor clients, third party risks, delay penalties, risk and revenue sharing)Corroborate target’s growth plan against its sales strategy, capabilities and competitive positioning

Be wary of the large variable costs inherent in fibre companies and evaluate the genuine synergies across resources

Properly evaluate the effort and costs required to integrate networks and systems, as well as customer churn

Operational Assessment

Check that the network fibre and optical equipment, as well as human resources, can support the product pipeline

Identify any lack of capacity or any obsolescence in the OSS/BSS and data management systems

Ensure that the appropriate PIA agreements are set up with local authorities, MDUs and infrastructure owners

Determine the fit between the fibre optic networks, equipment and human resources

Define how the network architecture and the systems will be integrated in the combined entity

Review the rollout plan and technical roadmap against business objectives, identify and mitigate operational risks, and validate the technical capex required against benchmarks

Acronyms

FTTP: Fibre to the Premise

FTTB: Fibre to the Building

FTTH: Fibre to the Home

DSL: Digital Subscriber Line (originally digital subscriber loop)

VDSL: Very high bit rate Digital Subscriber Line

HFC: Hybrid Fiber-Coaxial

FBB: Fixed Broadband

Subs: Subscribers

GPON: Gigabit Passive Optical Network

PSTN: Public Switched Telephone Network

DOCSIS: Data Over Cable Service Interface Specification

NGA: Next Generation Access Network

ISP: Internet Service Provider

M&A: Mergers & Acquisitions

JV: Joint Venture