The impact of LEO satellites

November 2019

INTRODUCTION

Up until recently, Low Earth Orbit (LEO) satellite constellations had been used for applications which need limited bandwidth such as Earth observation, remote sensing and asset tracking, and specific types of imaging and weather monitoring.

Nowadays, LEO constellations are also being developed for real-time and high-capacity communications, and they are attracting substantial investments.

Why? And what will be their impact on the telecom industry?

This article is based on a presentation prepared in collaboration with Xona Partners and given at the TMT Finance conference held in London on 28th November 2019. It describes the following aspects of the LEO satellite industry:

Advantages

Use cases

Projects

Market drivers

Challenges

Impact on GEO satellite operators

Impact on network service providers

ADVANTAGES

LEO satellites operate at an altitude of 300 to 1,600 km, which is closer to the Earth than Geosynchronous Equatorial Orbit (GEO) satellites.

LEO satellites benefit from more available paths than GEO satellites, which must orbit along the equator at an altitude of 35,786km.

At their relatively low altitude, LEO satellites travel at high speed around our Globe up to 16 times per 24 hours. This means that an individual LEO satellite stays within reach of a given ground station for barely 20 minutes and must transfer its data during this brief period of time.

In order to provide a wide and continuous coverage, LEO telecommunication satellites work together in large constellations, which offer the following benefits.

Performance and Ubiquity

LEO constellations can provide high-bandwidth internet connections around the World:

They are particularly useful in regions located outside (or for modes of transportation moving out of reach of) terrestrial networks.

They can be deployed in parts of the Globe not covered by GEO satellites (e.g. near the South and North Poles).

Low Latency

Crucially, LEO satellites offer lower latency than GEO satellites, thanks to their low orbit. This improves customer experience and opens up new satellite use cases.

LEO constellations using Inter-Satellite Links (ISLs) provide lower latency than submarine cables over long distances (>5,500km), because light travels faster in space than in a fibre-optic cable.

Resiliency

In addition, the network mesh of LEO constellations provides redundancy should one of the LEO satellites lose its connection.

Physical Security

LEO constellations are also less prone to physical attack than terrestrial and submarine fibre cables.

Rapid deployment

Once a LEO constellation is up and running, it is faster to connect enterprises located in remote areas with LEO terminal equipment than with fibre. It is also economically viable to set up temporary connections with LEO, but not with fibre.

Portability

The following enable the mobility and useability of LEO solutions:

LEO satellite equipment can be used by small planes and drones because it is smaller and consumes less power than GEO equipment.

LEO constellations can use terrestrial waveforms such as 5G and NB-IoT.

LEO vs. GEO orbits and latencies (source: Xona Partners)

USE CASES

LEO satellite constellations enable new use cases for consumers, enterprises and government agencies.

Broadband for the Unconnected

Global coverage in low-income countries which are poorly served by geospatial satellites (the business case is however unproven as ARPUs are very low in these regions)

High-speed Rural Broadband

High-speed Broadband in underserved rural premises in developed countries, where fibre broadband is uneconomical, and when ground equipment becomes inexpensive

Global Enterprise Connectivity

High-throughput connectivity with lower latencies than those of fibre for long-distance communication (useful in high-speed trading for instance), trunking for enterprises in developing countries with little fibre assets, or temporary connectivity for events taking place in remote areas

Complement of subsea cables

Submarine cable network extension, off-load, back-up, or stop-gap

Mobile Backhaul

Superior experience of satellite mobile backhaul for 4G and 5G in areas where terrestrial backhauling is not feasible (too costly, land regulation)

IoT Connectivity

Global coverage for Internet of Things (IoT) devices with limited mobile/ fibre connectivity (e.g. connected cars, devices in remote locations)

Connectivity on the Move

Increased coverage and superior throughput on the move (ships, planes, trains, trucks)

Remote Industries

Increased coverage and superior throughput to companies in remote locations (off-shore oil rigs, mining facilities)

Government, Defence, Critical Services

Superior performance for Government’s critical operations requiring bandwidth intensive applications, near real-time control and advanced sensor capabilities

Starlink

PROJECTS

Investors

LEO and Medium Earth Orbit (MEO) constellations attract tens of billions of US dolars in investment from digital giants, existing satellite communication providers, Venture Capital firms, government funded consortiums, and billionaires.

Major Internet / Cloud providers (e.g. Amazon, Google, Facebook)

Large scale technology players (e.g. Virgin, SpaceX, Softbank)

Existing GEO satellite communication providers (e.g. Intelsat, Telesat, Eutelsat, SES, Viasat)

Venture capital backed entities (e.g. OneWeb, Kepler, Sateliot, Lacuna, AST and 20+ startup constellations)

Government funded consortiums (e.g. China, Japan, Korea, Europe, US and UK)

Characteristics

LEO constellations try and differentiate themselves in terms of:

Markets

Segments

Use cases

Applications

Spectrum rights

Orbital planes and coverage

Throughput and capacity

Antenna capabilities

Lifespan

On-board processing and routing

Inter-satellite links

Stages

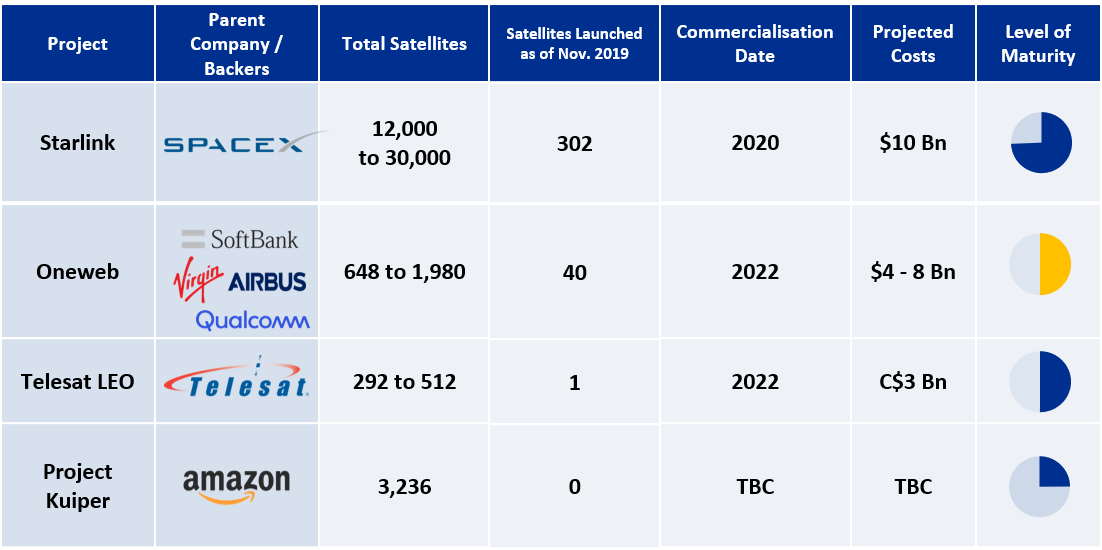

The second wave of LEO constellations features projects at various stages of development. The following table presents a sample of key initiatives in LEO ‘space internet’.

Examples of LEO satellite communication constellations (source: Spacenews, Crunchbase, companies’ websites)

Starlink

Starlink is a LEO constellation project of Space Exploration Technologies Corp. (SpaceX), and entity controlled by the Elon Musk Trust, and was publicly announced in January 2015.

Its primary goal is to “provide fast, reliable internet to populations with little or no connectivity”.

SpaceX predicts full coverage in 2020 through 720 satellites, and plans to complete the deployment of 12,000 satellites in 2027.

Starlink launched its first 60 satellites in May 2019.

In October 2019, Starlink requested permission from the FCC for an additional 30,000 satellites.

OneWeb

OneWeb is a company founded by Greg Wyler in 2012, whose shareholders include SoftBank, Qualcomm, Airbus and the Virgin Group.

OneWeb has raised $3.4bn since being founded in 2012. However, a question mark was raised over its future funding when Softbank wrote down its Oneweb stake by £380m in August 2019.

OneWeb has recently been targeting the maritime, aviation, government and enterprise sectors, after focusing on ‘remote homes’ initially.

OneWeb launched its first six satellites in February 2019 but had to delay its first full-up launch to early 2020.

Telesat LEO

Telesat, a GEO satellite operator headquartered in Ottawa, Canada, announced in April 2016 that it would launch a LEO constellation.

Its CEO stated the constellation would target “global broadband markets, (…) government users, anybody with a mobility application, and users in rural and remote areas.”

In January 2018, Telesat launched one LEO satellite for trials.

In May 2019, Telesat conducted the first ever 5G connection over a LEO satellite. This test demonstrated “latencies of 18-40ms and throughputs up to 60Mbps for the most favourable visible orbits”.

Project Kuiper

Amazon set up its subsidiary Kuiper Systems LLC in April 2019.

This long-term project will serve “millions of people lacking basic broadband”, and will also broaden the coverage of Amazon Web Services (AWS).

Very few details have been published so far and the launch plans are yet to be revealed.

In November 2018, it was announced that the new AWS Ground Station would build 12 satellite facilities.

First 60 Starlink satellites launched into orbit in May 2019 (credit: SpaceX)

MARKET DRIVERS

The development of LEO constellations is gathering pace, ‘fuelled’ by the following drivers and enablers:

Requirements

Connectivity anytime anywhere

Low latency

Low cost

Demand Drivers

Ubiquitous demand

Digital content and applications

Connected devices

Billions of devices (IoT)

Millions of applications (OTTs)

Automation

Financial Enablers

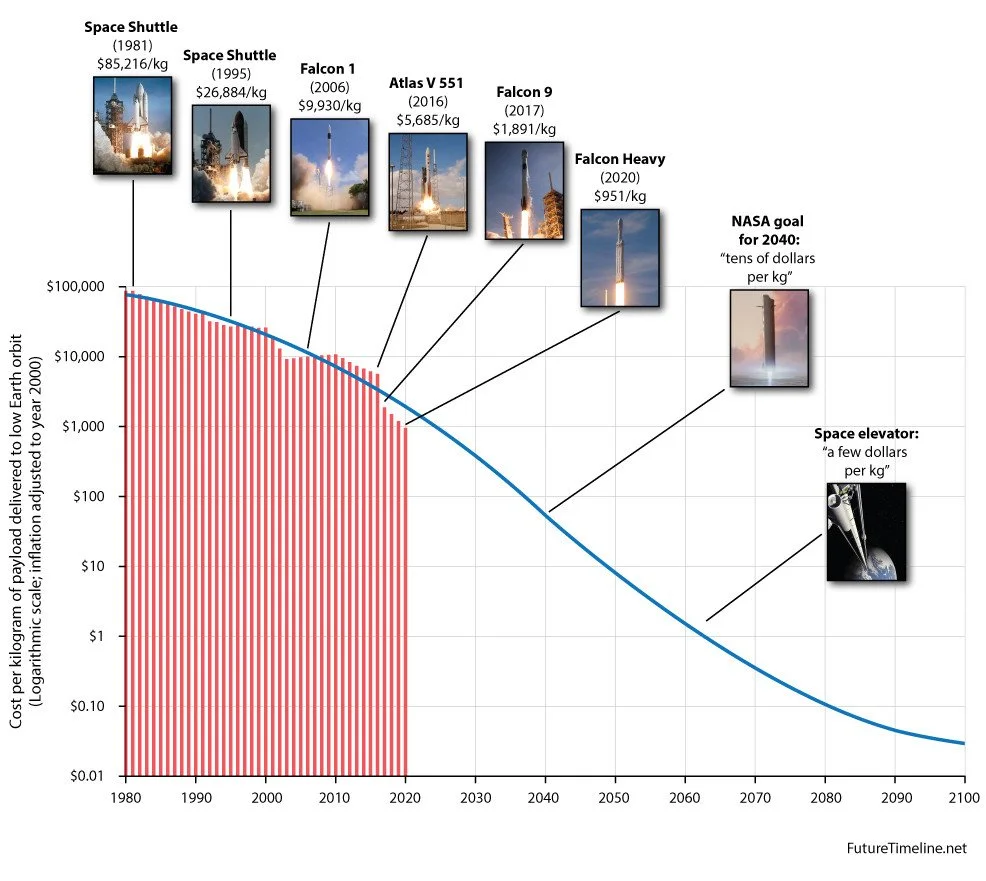

Declining launch costs thanks to new technology

Declining satellite build costs thanks to their small size

Large scale of private funding

Technology Enablers

Ground: 5G, MEC, automation

Satellite: optical space links, new phased array antennas

Regulatory Enablers

Satellite included in 5G standards

Spectrum rights awards

Major rural funding programs (e.g. FCC US)

Satellite launch cost (source: Future Timeline)

CHALLENGES

LEO satellite communication is not a new concept. The LEO satellite phone operators Iridium and Globalstar famously went bankrupt two decades ago.

They reemerged though with new shareholders after going through Chapter 11. Iridium upgraded its constellation in January 2019 (Iridium Next), and launched Iridium Certus, its new broadband service, which uses the spectrum L-band and initially targets specific maritime and terrestrial customers in remote areas.

What’s more, the market drivers and enablers are different this time. Notably, technology has progressed, satellite and launch costs have declined, and demand for data has exploded.

Yet, the renewed LEO market still presents high risks in conjunction with its high rewards. As LEO constellations ‘version 2.0’ are in their early stage and they face a long time to market and then to breakeven, some of them may suffer the same fate as their predecessors. For instance, Leosat has failed to raise follow-on funding and was forced to shut down in November 2019.

Securing revenues from the most rewarding Enterprise segments and use cases, as well as developing affordable user terminals, will be crucial before deploying large scale constellations aimed at digital inclusion.

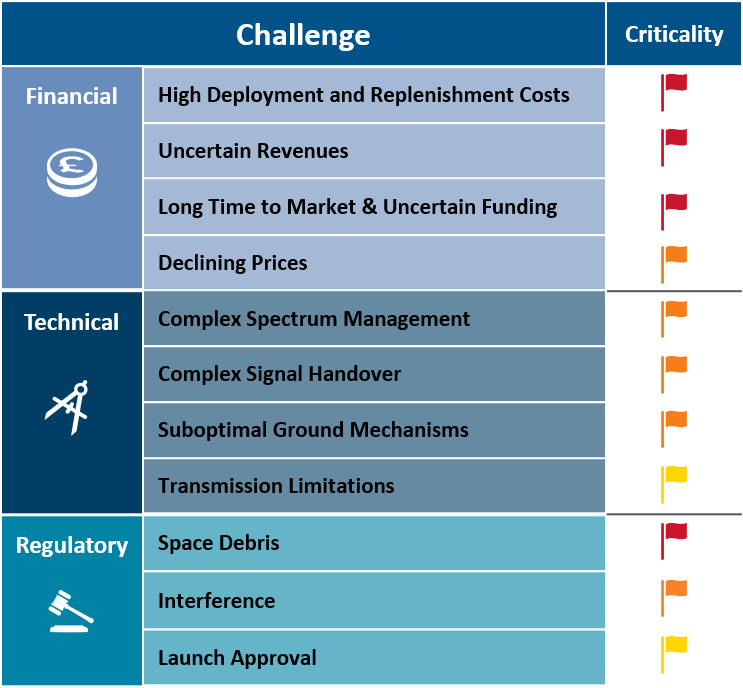

This section provides an overview of the financial, technical and regulatory challenges that LEO constellations are facing.

LEO Satellite Constellation Challenges

Financial challenges:

High deployment and replenishment costs

Even though the unit costs of LEO Satellites are lower then these of GEO, a large number of LEO satellites are required to provide high-capacity and continuous global coverage.

A large number of gateways / earth stations are required to synchronize satellites.

Satellites must be replaced periodically due to short life span (5 years for Starlink, 10 years for Telesat).

Uncertain revenues

Convincing enterprises to use satellite could prove to be challenging if alternative communication technologies are available.

LEO equipment (e.g. flat panel antenna) is still too expensive for consumer broadband customers.

The share of HTS revenues and of IoT revenues is uncertain.

If all providers succeed in launching services, it is unclear if there will be sufficient market for all.

If their revenues grow slowly, operators will not be able to fund the CapEx required to build new satellites/ground stations.

Declining prices

The increase in capacity and competition is putting pressure on prices.

Long Time to Market & Uncertain Funding

Service launch is a few years away for most constellations and funding may dry out in the interim.

Victims already include LeoSat (Leo satellites for global broadband services), Vector (small satellite launcher), and Audacy (MEO constellation).

Rationalisation and consolidation will continue.

News article annnouncing the demise of Leosat (source: Space News)

Technology challenges:

Complex Spectrum Management

Frequency synchronization is complex.

Coordination with GEO is also required in some cases.

Complex Signal Handover

Many handovers are needed considering the numerous moving satellites and the smaller beams.

More technologically-advanced antennas and tracking capabilities are required.

Suboptimal Ground Mechanisms

Terrestrial mechanisms are currently not optimal for LEO networks.

LEO space networks are still in early stages of internet/wireless networking.

Transmission Limitations

Satellite communications can suffer from increased signal noise from moisture and precipitation, which can be mitigated through additional expertise and technology, and decreased bit rates.

Regulatory challenges:

Space Debris

LEO satellite operators must provide mitigation plans detailing how they will remove space debris to prevent in-orbit collisions.

Operators are designing small satellites with materials which disintegrate when entering the atmosphere.

Interference

The International Astronomical Union is urging “appropriate agencies to devise a regulatory framework to mitigate or eliminate the detrimental impacts on scientific exploration” in response to LEO obstruction and interference.

Launch Approval

Regulatory approval must be received from the FCC, and may be withdrawn if half of the operator’s satellites are not deployed within 6 years of approval, and if all satellites are not deployed within 9 years.

SpaceX Starlink Satellites (credit: Marco Langbroek, Leiden, The Netherlands)

IMPACT ON GEO SATELLITE OPERATORS

GEO satellite providers face the increasing competition from LEO constellations, as well as the decline of video broadcasting sales and the erosion of capacity prices. Thus, they need to reinvent themselves and move down the value chain.

Market trends

Satellite growth in IoT, mobility, and government

Weak demand in satellite video broadcasting due to the success of video streaming and Over The Top (OTT) services

Increasing demand in capacity but declining prices due to intense competition and new capacity coming from High Throughput Satellites (HTS)

MNOs focusing on urban areas and de-investing in non-core assets

SDN transforming terrestrial networks and business models

Actions required

Create new business opportunities

- Segment and target markets (focus on Enterprise initially)

- Study customer requirements, forecast demand (e.g. HTS, IoT)

- Identify and define new services and applications

- Analyse price elasticity and adjust pricing model

- e.g. Offer network-as-a-service in rural areas

Complement GEO with LEO (partnership or acquisition)

Partner with mobile network operators

Integrate within 5G

Complement submarine networks

Play a connectivity role in cloud / edge deployments

Develop the next generation of space networks

Ensure interoperability

IMPACT ON NETWORK SERVICE PROVIDERS

LEO satellite providers may capture revenues from terrestrial Network Service Providers in specific Enterprise verticals, and in Rural Consumer Broadband when ground equipment becomes affordable. Telecom operators will need to expand their service portfolio.

Enterprise segment

Some companies currently not using satellite connectivity services could be attracted by LEO satellites’ offering of high resilience, security and even reduced latency for long-distance connections.

These companies could decide to shift some of their connectivity spend to the LEO satellite providers, and away from traditional Fiber Service Providers

Examples could include companies in the Financial sector, Mobile operators (using satellite for some 5G backhaul), IoT solution providers, Government/Military

Consumer segment

In the Consumer segment, LEO satellite operators are focusing on rural regions of developed nations, instead of targeting only developing nations, as higher ARPUs will improve payback time for their investment.

In the US, traditional Service Providers could face additional competition from Satellite ISPs in 18m underserved households, leading to prices declines and lower market share

If LEO satellite internet proves a cost-effective solution, the US Government could stop/reduce subsidies to deploy fiber networks

First though, ground equipment must become inexpensive

Actors involved in the LEO satellite industry (source: Xona Partners)

CONCLUSION

LEO satellite operators will partner with OTT players, mobile operators, data centre operators, and ground equipment manufacturers. LEO satellite vendors, launch companies, and insight / analytical companies will directly benefit from this burgeoning industry.

On the other hand, LEO constellations will impact GEO satellite operators and terrestrial fixed-telecom operators and, to a lesser extent, telecom wholesalers and submarine cable operators (. Competitive developments include greenfield entrants and vertical integration.

Despite this high level of competition, collaboration is required for the LEO constellations to succeed. Some use cases will need the integration of wireless, fixed, FWA, and satellite. This will prompt satellite operators, service providers, telecom operators, and equipment providers to put partnerships in place.

Should you be interested in finding out more about the technology aspects of LEO satellite constellations, click here to download the report ‘Space Intersects Internet: Opportunities and Challenges' from Xona Partners .