Reigniting Technology: The Future of OpenNet, 5G, and Reality+

March 2023

INTRODUCTION

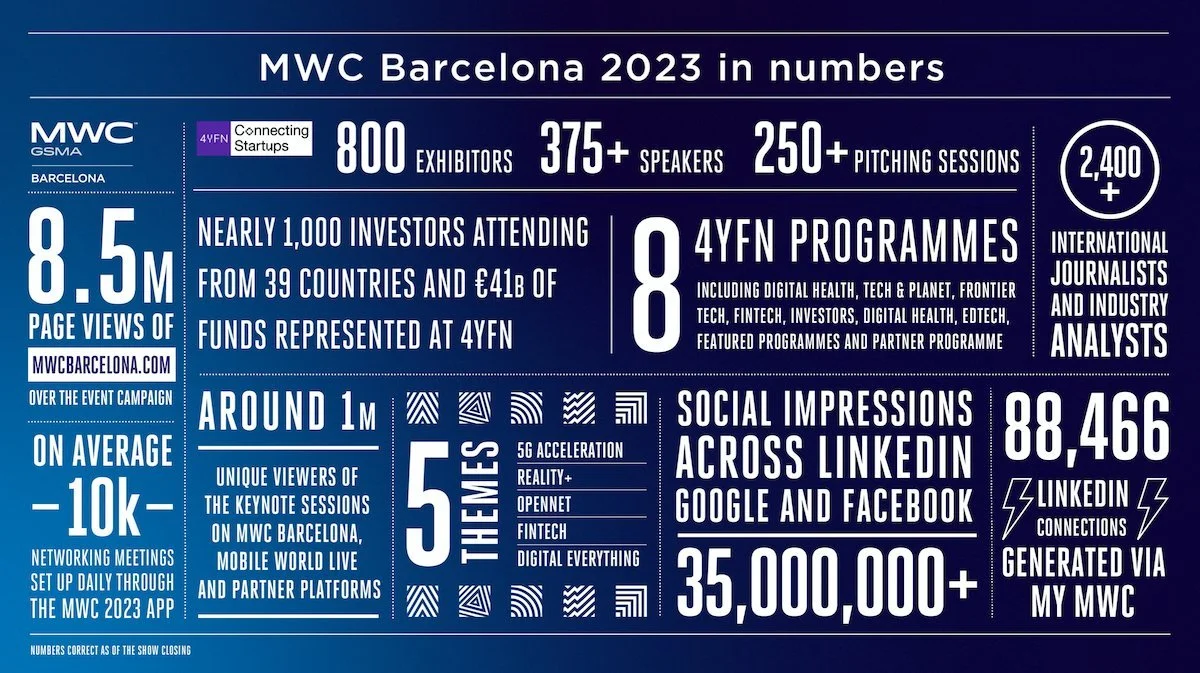

In 2023, the Mobile World Congress (MWC23) regained much of its past lustre as the number of attendees reached 81% of its 2019 edition. A total of 88,500 professionals were delighted to meet in person again following the Covid-19 pandemic.

In our initial coverage of MWC23, we examined the state of the mobility industry and its sustainability efforts. In this second instalment, we will delve into the technology themes presented at the global event:

Open Networks: GSMA’s newly launched Open Gateway initiative, OpenRAN, VRAN, and eSIM

5G acceleration: private enterprise networks, spectrum requirements, and progress toward 6G

Digital Everything: edge computing, IoT, AI, and quantum security, and their applications in sectors such as smart mobility in the automotive industry

Reality+: the state of the metaverse, including the latest augmented and virtual reality technologies, and gaming innovations

Credit: GSMA

OPEN NETWORKS

This chapter provides an overview of the developments in open networks at the MWC23 conference. It first covers initiatives aimed at simplifying application programming interfaces (APIs) to promote application innovation, such as the GSMA's Open Gateway, T-Mobile and Deutsche Telekom's T-Dev Edge, and Ericsson's Global Network Platform (GNP). The chapter then discusses the announcements made at MWC23 regarding Open RAN, and highlights the challenges and uncertainty that remain in the industry. Finally, the chapter presents the MWC23 news related to vRAN and to eSIMs.

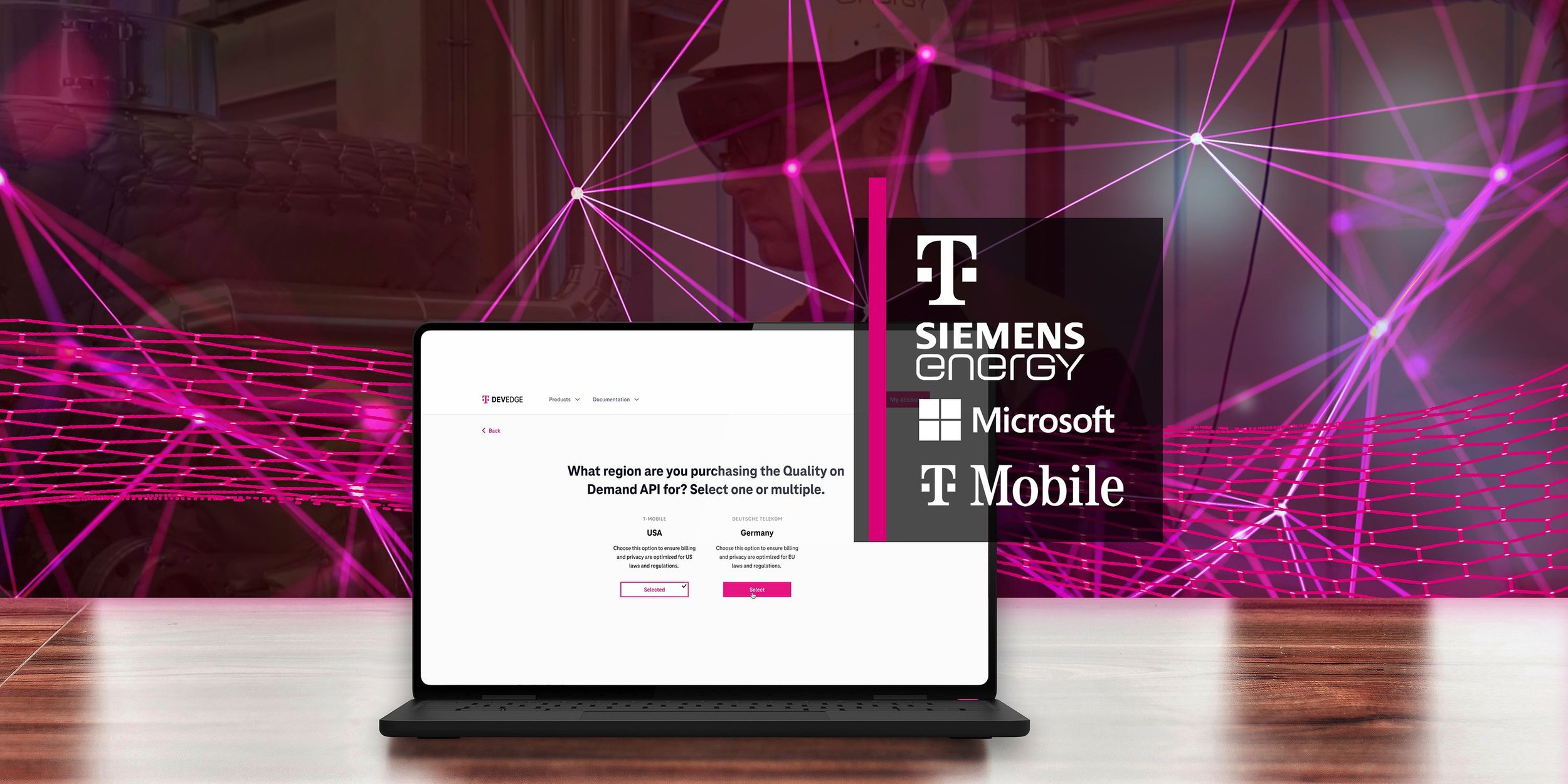

T-Dev Edge, Credit: T-Mobile

Open APIs

At MWC23, there was a strong emphasis on collaboration between industry players. One of the key takeaways from the congress is the drive to simplify Application Programming Interfaces (APIs) in order to enable the unique capabilities of telecom networks and promote application innovation. This section examines three initiatives aimed at achieving this goal: The GSMA’s Open Gateway, T-Mobile and Deutsche Telekom’s T-Dev Edge, and Ericsson's Global Network Platform (GNP).

Open Gateway

Overview

The GSMA introduced the Open Gateway initiative, which aims to transform the global mobile platform into a global open and interoperable computing platform, also known as "earth computing."

This new API framework will provide developers with universal access to operator networks. Open Gateway will enable developers to integrate calls, texts and other telephony functions directly into applications or software, allowing them to access and use various mobile network services like location, identity verification, and carrier billing in a more cost-effective manner. The APIs are defined, developed and published in CAMARA, an open-source project for developers created in 2022 by the Linux Foundation in collaboration with the GSMA Operator Platform Group.

Applications

The initiative already has the support of 21 operators, including AT&T, China Mobile, KDDI, Orange, Telefonica, Verizon, and Vodafone. Thus, the initiative will provide access to 3.9 billion users, and 8 universal network APIs will be available at launch, with plans for additional APIs to be introduced in the future.

SIM Swap (eSims to change carriers more easily);

Quality on Demand (QoD);

Device Status (Connected or Roaming Status);

Number Verify Edge Site Selection and Routing, Number Verification (SMS 2FA) and

Carrier Billing – Check Out and Device Location (where a service needs a location verified).

Use cases

At MWC23, Telefonica and other leading operators demonstrated interesting use cases for this initiative, such as mobile gaming, interactive high-definition video, and number verification and device location. In his keynote speech, Jose María Alvarez-Pallete, Chairman and CEO of Telefónica, heralded the dawn of a new era driven by the intersection of telecommunications, computing, artificial intelligence and Web 3.0. He referred to the newly launched GSMA Open Gateway initiative that aims to bond telcos, the industry, big tech and developers to create the digital future together. Alvarez-Pallete highlighted the remarkable collaboration established with Microsoft, AWS and Google Cloud.

Outlook

Open Gateway is currently in its early deployment stages and will require 5G Stand Alone. It is important to note that similar GSMA initiatives, such as the Wholesale Applications Community (2010) and OneAPI Exchange (2012), have failed in the past. Additionally, other API projects have been launched, including T-DevEdge. Cloud-based open RAN 5G network operators Rakuten and Dish have also published their own APIs. Therefore, there may be doubts about the potential success of the Open Gateway initiative.

However, the GSMA hopes that the introduction of 5G networks and the support of Hyperscalers such as AWS and Cloud will make its new initiative a success.

T-DevEdge

At MWC23, T-Mobile US and Deutsche Telekom unveiled their joint platform called T-DevEdge, which features shared Application Programming Interfaces (APIs). The platform is designed to make it easier and more straightforward for developers worldwide to build new connected solutions. Through these APIs, developers will be granted a simplified and direct entry point to connectivity and other essential network services on both sides of the Atlantic. Microsoft has integrated the new set of network APIs into their cloud platform, becoming the first cloud provider to do so using the Microsoft Azure Programmable Connectivity Software Development Kit (SDK). Siemens Energy, the first user of this platform, is utilising one of the new APIs for Quality-on-Demand to enhance its remote maintenance operations.

Ericsson's Global Network Platform

Ericsson's Global Network Platform (GNP) aims to consolidate and expose the network capabilities of mobile operators to enterprises and developers. The collaboration between Ericsson, Zoom, and Spanish operators demonstrated the use of APIs like Quality on Demand (QoD) to deliver improved customer experience and generate revenue. Other APIs being considered include SIM Swap, Device Status, Location, and Silent Authentication. The commitment to API exposure and the platform economy represent a business model shift that could create new sources of value.

Open RAN

The concept of Open Radio Access Networks (Open RAN) involves the interoperability of open hardware, software, and interfaces for mobile networks.

This section provides updates and insights into the Open RAN landscape, as discussed at MWC23. Deutsche Telekom and Vodafone have both announced plans to deploy Open RAN across Europe, while Rakuten and Vodafone called for more collaborative efforts to further fuel the Open RAN ecosystem. Despite these positive developments, there is still uncertainty in the industry due to the complexity and integration costs of Open RAN. This section also highlights the current sentiment towards Open RAN, with investment in the technology lacking and only a few companies successfully building such networks.

MWC23 Announcements

Deutsche Telekom plans commercial Open RAN rollouts

Deutsche Telekom has announced plans to work with Nokia, Fujitsu, and Mavenir on initial commercial deployments of Open RAN.

One of the rollouts will be in Neubrandenburg, where Nokia and Fujitsu will partner with the German operator to deliver 2G, 4G and 5G services from a “brownfield” network deployment, though the scale of the rollout has not been shared.

Mavenir has been chosen for DT’s Open RAN deployment in a European country of its footprint. Mavenir will provide its OpenBeam massive MIMO radios as well as 3rd party O-RAN based Radio Units (O-RU) for open Fronthaul.

Vodafone selects Samsung for Open RAN deployments

Samsung Electronics and Vodafone Group have announced plans to deploy Open RAN across Europe, starting with network initiatives in Germany and Spain, while enhancing Vodafone's 5G network in the UK.

Samsung's virtualised RAN platform will be used in further pilot projects in Germany and Samsung will deploy its Massive MIMO radios and 4G/5G vRAN in Ciudad Real Espana to evaluate and verify performance in Spain's urban environment.

The companies have already implemented Samsung's O-RAN Alliance-compliant Massive MIMO radios in Vodafone UK's commercial network and recently completed a data call demonstrating multi-vendor interoperability for Vodafone's network.

Rakuten Symphony and Zain KSA collaborates

At MWC23, Rakuten Symphony and Zain KSA announced their collaboration in building advanced telecommunications networks. The two companies have signed a Memorandum of Understanding (MoU) to work together in deploying next-generation mobile network services based on open standards and Rakuten Symphony's network infrastructure.

Rakuten Symphony will assist Zain KSA in developing a cloud-native, fully virtualized radio access solution architecture that will be Open RAN 4G and 5G-based.

Nokia launches anyRAN

Nokia has launched anyRAN, a solution that allows mobile operators and enterprises to choose between purpose-built, hybrid, or Cloud RAN regardless of business model. The company has signed go-to-market agreements with the world's leading cloud infrastructure and server providers, giving customers flexibility in their choice of hardware, Cloud infrastructure, and data centre solutions for running Cloud RAN. Nokia's Cloud RAN Smart Network Interface Card (NIC) with in-Line Layer 1 acceleration ensures performance parity across purpose-built, hybrid, or cloud networks.

Calls for action at MWC23

There is speculation and uncertainty in the industry regarding Open RAN:

Complexity and integration costs are major challenges, especially when it comes to ensuring interoperability at the level of reliability demanded by Mobile Operators.

Operators are unclear about whether they need to act as systems integrators to benefit from open RAN.

Lawmakers and government officials also have a limited understanding of Open RAN.

Thus, Rakuten and Vodafone made calls for action at MWC23.

Rakuten

Rakuten engaged with operators to promote the benefits of Open RAN deployments and stated that:

The O-RAN Alliance and Policy Coalition need to play a bigger role in educating and presenting a compelling business case for Open RAN.

Operators need to learn from other mission-critical, cloud-based industries such as healthcare or finance.

The best way to convince operators of the benefits of Open RAN is to point to successful launches like Rakuten Mobile.

Vodafone

Meanwhile, Vodafone's head of Open RAN, Francisco 'Paco' Martin, appealed for more operators to get involved in collaborative work that would further fuel Open RAN ecosystem activity, as no other telcos in Europe have committed resources to the Open RAN cause.

Open RAN Outlook

Initial expectations

The move towards Open RAN was expected to offer more flexibility in the network, allowing operators to replace equipment more easily. Open RAN and advancements in Artificial Intelligence were deemed crucial in optimising network automation and service performance. Together with 5G, OpenRAN would play a key role in the transformation of mobile operators into telecom platforms, and would challenge the dominance of major equipment suppliers such as Huawei, Ericsson, Nokia. Thus, Open RAN could help mobile operators become independent from major equipment vendors in a global and open ecosystem.

Current sentiment

The announcements made at MWC23 were encouraging for Open RAN. However, the Open RAN movement has yet to be deployed in significant numbers.

AT&T is continuing with trials and lab tests and is not currently rolling out Open RAN technology, even though AT&T's CTO of networks, Igal Elbaz, stated that the development and deployment of open and disaggregated RANs are important for future innovation.

Whilst Ericsson intends to make Open RAN technology a long-term portfolio for the company, this will likely start in 2025 only.

Despite the buzz around Open RAN, investment in the technology is lacking, with Ericsson expecting the RAN market to shrink globally by 1% this year and by 7% in North America.

Three companies, Rakuten in Japan, Dish in the US, and 1&1 in Germany, are building Open RAN networks but are facing challenges:

Rakuten’s LTE network does not follow O-RAN Alliance standards and lacks scale.

Dish has embarked on deploying Open RAN with more than 20 vendors, but the company has faced challenges with system integration and selected Samsung for its 5G Open RAN network rollout in May 2022.

1&1’s 5G network rollout has been delayed due to site development and acquisition issues with construction partner, Vantage Towers. Meanwhile, incumbent operators are trying to persuade Germany's Federal Network Agency to abandon its plan for a low-band spectrum auction, which 1&1 requires. Whilst these issues are not linked with Rakuten Symphony’s Open RAN equipment, this is detrimental to Open RAN, since mobile operators are waiting for evidence that the open, disaggregated, multi-vendor approach generates practical benefits.

Thus, although Open RAN is still on the way, it has lost its ‘zest’:

Meaningful and impactful Open RAN activity from the telcos is still around five years away.

Integration costs may wipe out any equipment cost savings.

The Open RAN market may end up being dominated by traditional equipment vendors.

The only clear opportunity for Open RAN players is with new-build networks, which are costly to deploy and require spectrum held up by incumbents.

Open RAN requirements

To overcome the complexity of Open RAN networks, a greater degree of network automation is required to optimize services for various use cases and support different terminal types.

Optimizing network performance is also needed in order to offer new sources of revenue for the telecoms industry and added value to its users.

Using AI will be beneficial to directly optimise network performance for individual users/applications.

Improving customer experience and service performance will be crucial as the industry enters a new age of immersive services that rely on high performance and efficient network infrastructure.

To truly showcase its performance, interoperability, and low latency, Open RAN needs to be deployed on a large scale in a real-world 5G network in an urban environment.

VRAN

Virtualized radio access network (vRAN) is a type of network architecture that separates the hardware and software components of the traditional RAN. In a vRAN architecture, the baseband processing functions are executed by virtual machines running on commodity servers located in the cloud (or a centralised data centre). This allows for greater flexibility, scalability, and cost efficiency in deploying and managing mobile network infrastructure.

In this section, we will review the latest news from Red Hat and Spirent Communications at MWC23.

vRAN News

Red Hat partnered with Samsung

Red Hat, owned by IBM, has announced new and extended partnership agreements aimed at promoting its open-source agenda for 5G deployments.

The company has collaborated with Samsung to develop a virtualised radio access network (vRAN) solution that will help service providers manage networks better at scale, increase flexibility, and operational efficiency.

The company also announced collaborations with Arm, NEC, Airspan, Druid, Nvidia, and Omron for the development of more energy-efficient 5G and vRAN solutions and addressing private 5G networking.

Honoré LaBourdette, VP, Telco, Media, Entertainment & Edge Ecosystem at Red Hat, stated that "no single vendor can meet the demand for RAN technologies on their own," and partnerships will “equip service providers with the necessary scale and efficiency for any given radio network”.

Spirent Communications highlighted the importance of test and measurement

Jurrie van den Breekel, VP of Strategic Partnerships at Spirent Communications, described the complexity of migrating to cloud-native 5G core, MEC, and vRAN.

The migration to new network technologies requires the integration of products from multiple vendors, which is a complicated process.

In a cloud-native environment, updates are unpredictable and must be tested swiftly

Operators are moving towards “continuous test and monitoring lifecycles for more straightforward and lower-cost operating environments with automation.”

Outlook

The strategy of promoting open and virtualized radio access network solutions is yet to pay off in the service provider sector despite the promises of Vodafone (30% of European networks by 2030, or 30,000 sites), Telefonica and Orange among others of such deployments.

eSim, Credit: Deutsche Telekom

eSIM

The eSIM has quietly emerged as a successful technology, although it received limited media attention.

With their ability to facilitate private networks, roaming services, and numerous other consumer-oriented applications, eSIMs have the potential to offer significant benefits to end-users, potentially at the expense of established operators.

This section discusses the partnership between Deutsche Telekom and Google to develop a global standard for transferring eSIMs between mobile devices, and the CloudSIM approach, which moves the SIM function into a secure cloud environment.

Deutsche Telekom and Google partnership to develop a global standard

Deutsche Telekom has collaborated with Google to develop a global standard for transferring eSIMs between mobile devices and is now the first mobile communications company in the world to offer this service to customers.

The new process is seamless, easier, faster, and more secure as customers transfer their mobile contracts to their new device with a few clicks. There is no need to use an app or a website, nor to contact a call centre.

The eSIM transfer capability will become available on the Android platform later this year.

CloudSim

A new approach, called CloudSIM, moves the SIM function into a secure cloud environment to enable devices to connect to cellular networks on demand.

It eliminates the complexity and interoperability challenges of integrating SIM functionality into devices while providing flexibility, scalability, and security.

The next generation of connectivity will save resources and optimise benefits, by merging traditional permanent SIM/eSIM connections with a remote enabler for on-demand connectivity.

Deutsche Telekom partners Microsoft to offer 5G Private Networks, Credit: Deutsche Telekom

5G ACCELERATION

The number of 5G mobile subscriptions has reached 8.1%, and discussions at the congress now revolve around its evolution and progress made to date. Despite some actors expressing disappointment with the slow journey to 5G, such technological leaps usually take a decade. Indeed, the network deployment of a new mobile generation typically lasts three years, and it usually takes another two years to experience its first applications. Thus, 5G is still relatively in its infancy, despite the name of the theme at MWC23.

This chapter explores the current state of 5G private enterprise networks, the emergence of mmWave technology, as well as the potential 5G use cases and their challenges.

It also covers the 5G initiatives and partnerships announced at MWC23, such as:

Verizon and Telia deploying 5G and edge compute to improve various aspects of logistics

Deutsche Telekom's collaboration with Microsoft for private 5G networks and Nokia's partnership with Indosat Ooredoo Hutchison to accelerate Indonesia's digital transformation

Finally, this chapter discusses the spectrum requirements for the second wave of 5G, and the lack of appetite for 6G.

5G Private Enterprise Networks

In this section, we discuss the latest news and trends in the realm of private 5G networks. We first cover Accenture's Manufacturing Summit and how 5G and metaverse applications can impact the manufacturing industry. We then highlight the recent partnerships between companies such as Deutsche Telekom and Microsoft, and Nokia and Indosat Ooredoo Hutchison. Thirdly, we provide the perspective of Intel on the use cases of private 5G networks. Lastly, we discuss the outlook for private enterprise networks and how they may provide a source of additional revenue for operators and vendors.

Accenture’s Manufacturing Summit

At Industry City, beyond the main stage, engaging discussions showcased the applications of 5G in manufacturing and emphasized the tangible business impact of metaverse, particularly in B2B solutions. Experts from various companies including Schneider, Palo Alto Networks, Arcelik, Verizon, NTT, NVIDIA, Tonumus, KPN, Siemens, and Singtel presented practical examples of 5G and metaverse use cases. Executives from Qualcomm disclosed that despite technological advancements, over 80% of warehouses still lack automation, and approximately 82% of companies encounter at least one unplanned downtime each year, which costs them around $50 billion. By adopting a gradual approach instead of a sudden transformation, 5G can energize the realm of manufacturing and logistics.

Verizon

Verizon, Accenture, and AWS are deploying 5G and edge compute to “improve inventory management, production speeds, quality, energy consumption, cost savings, safety, and efficiency”.

Telia

Telia announced a new solution that runs on AWS and “improves the efficiency and accuracy of Finnish logistics leader Transval’s services by leveraging video-recognition, private 5G networks and edge computing”.

Partnerships

Deutsche Telekom collaborates with Microsoft to offer 5G private networks

DT offers a new “end-to-end solution based on Microsoft Azure private MEC including edge platform, networking to offer modern connected applications, for standardized 5G campus network solutions with low barriers to entry, targeted at small and medium business customers, as well as those with existing Azure landscape”.

Deutsche Telekom announced a collaboration with Microsoft for private 5G networks, known as 5G campus networks. The company has successfully launched a pilot to create a new offering with a leading pharmaceutical company in Germany.

Deutsche Telekom complements its portfolio of 5G private networks for industrial use in Europe with a scalable, pay-as-you-grow model and price plans that lower the barriers to entry for 5G campus networks.

The solution is built on Microsoft Azure private multi-access edge compute (MEC) which includes the new Azure Private 5G Core service deployed on Azure Stack Edge to provide customers with a private network that is reliable, secure and can operate across multiple sites. The newly developed concept integrates new and existing customer applications to quickly deliver secure, cloud-managed solutions at the edge.

Nokia and Indosat Ooredoo Hutchison (IOH) partnership to accelerate Indonesia’s digital transformation

Nokia and Indosat Ooredoo Hutchison (IOH) have signed a Memorandum of Understanding to launch an advanced enterprise campus private wireless network in key regions across Indonesia (East and Central Java, Sumatera and Kalimantan). “Industrial-grade private wireless maximizes use of Industry 4.0 technologies to boost productivity, increase automation, and enhance safety and security.”

The collaboration aims to improve operational efficiency and boost productivity, increase automation, and enhance safety and security in zones vital to economic growth in Indonesia, as well as providing guaranteed connectivity for people and machines.

Private 5G network use cases

According to Caroline Chan, VP of the Network and Edge Group at Intel, the private 5G network industry is at an inflection point where opportunities, ecosystem, and products are coming together to ramp up deployments across various verticals and use cases.

While there is tremendous growth underway for private 5G networks across industrial use cases with exponential growth expected over the next decade, the main challenges for private networks have been system integration and proven use cases.

Chan stated that enterprises see the value of implementing private 5G networks including connectivity for multiple devices, protection of data and the agility to scale solutions in the future. The verticals that are showing interest include small and medium businesses, schools, stadiums, airports, events and hospitals.

Outlook

Private Enterprise Networks (PENs) are seen as a potential source of additional revenue for operators and vendors, but are being developed at varying rates worldwide. Many vendors are positioning their solutions and collaborating with systems integrators to deploy private networks.

The emergence of mmWave technology for private networks has led to questions about the potential market size. Additionally, there is recognition that small cells are necessary instead of costly server-based split-architecture ORAN solutions, which had previously been the chief are of interest of the infrastructure equipment ecosystem. This change in perspective will affect the entire supply chain, including semiconductor and equipment vendors.

Credit: GSMA

5G Spectrum

This section covers several topics related to 5G spectrum. The first topic discusses the launch of the "first commercial mobile 5G millimeter (mmWave) network" by Telefónica, Ericsson, and Qualcomm. The second topic focuses on the second wave of 5G deployment and the importance of spectrum for driving its capabilities. The third topic covers the issue of convergence in smart cities, where multiple technologies must work together. Finally, the text concludes with an outlook on the current state of mmWave technology and its potential role in future wireless technology evolution.

5G mmWave network

Telefónica, Ericsson and Qualcomm launched the “first commercial mobile 5G millimeter (mmWave) network” at MWC23.

• Telefónica obtained the 26GHz spectrum bandwidth in the recent Spanish auction

• Ericsson provides its radio access network equipment, powered by the Ericsson Silicon chipset,

• Qualcomm’s Snapdragon mobile platforms power a range of 5G mmWave devices.

The use of 5G mmWave (26GHz) spectrum offers high speeds and high capacity especially in areas with intensive traffic needs in indoor and outdoor environments.

Second wave of 5G

The initial deployment of 5G has reached 1 billion subscriptions. The second wave will expand 5G in existing areas, launch it in new geographies, and bring more of its capabilities to reality.

Spectrum is crucial to drive the capabilities of the second wave of 5G:

High-band spectrum, particularly mmWave, will unlock new possibilities for enterprise use-cases, but it requires a mix of other spectrum resources to be cost-effective.

Mid-band spectrum, which played a major role in the first wave, will continue to be essential for delivering city-wide capacity for urban areas.

Low-band spectrum will be key in addressing coverage gaps and digital divide challenges, especially in rural areas.

More spectrum is required for 5G. The upcoming World Radiocommunication Conference 2023 (WRC-23) will consider additional spectrum resources in low and mid bands for 5G use.

Convergence

Convergence is required for smart cities, which must deal with CBRS, mmWave, Wi-Fi 6/6E, LoRa, licensed and unlicensed spectrum, private networks.

Outlook

The current state of mmWave is comparable to mid-band spectrum (e.g. C-band/3.5 GHz) in the 2000s before the introduction of massive MIMO technology as implemented in 5GNR. Many mobile network operators (MNOs) are indifferent to mmWave, which is simply part of their spectrum inventory. Outside the United States, auction results show that MNOs lack interest in mmWave, as demonstrated by the numerous auctions that failed to attract their attention, with most of them achieving only the reserve price.

Deployments of mmWave in their three main applications (mobile, fixed wireless access, and private networks) are still limited, which could harm the business case of vendors, particularly in a high-cost-of-capital environment where the positive return on investment is pushed further into the future. However, we expect mmWave to play a role in the future wireless technology evolution, such as 6G and satellite-borne mobile networks, as advances in semiconductors will result in greater signal processing capabilities, contributing to improved cost/benefit tradeoffs.

6G

At this year's Congress, there were several exhibits related to 6G. Ericsson showcased its 6G network solutions, including its range of energy-saving solutions and live digital twin of a 6G network. Samsung Networks highlighted its plans for 6G, which include expanding network coverage and optimizing connectivity. The Next Generation Mobile Networks Alliance (NGMN) also discussed their work on fulfilling their vision for 6G during a press briefing. Other exhibits at MWC23 referenced 6G from various perspectives, such as potential applications and specific technologies. However, 6G was not the main focus of the event, as operators are still searching for ways to monetise 5G.

MWC23 6G Exhibits

Ericsson 6G Network Solutions

Ericsson held a series of demonstrations of its new network solutions aimed at accelerating digitization of the telecom industry, from its fixed wireless access portfolio to a live digital twin of a 6G network.

One of the key demos will be the company’s Radio System hardware wall and tower, featuring an array of Ericsson’s latest products from radio access network and transport portfolios. The company will also showcase its range of energy-saving solutions and 6G-driven technologies, with exhibits including zero energy sensors, live digital twinning of a 6G network, and potential capabilities of a new 6G spectrum.

Samsung Networks’ 6G roadmap

At MWC23, Samsung Networks stated that 6G should offer a peak speed of around 1,000 Gbps, with a user's average speed of 1 Gbps. The company also highlighted its plans to expand network coverage, with 6G covering 107 terminals per square kilometer. Samsung is also exploring new ways to optimize connectivity, such as split-computing, especially for IoT devices that rely on wireless connectivity.

Other 6G exhibits

Other exhibits referenced 6G at MWC23, but this was not their main focus.

Some displays presented 6G from the perspective of its potential applications, such as Nokia's sensing technology, which is already integrated into vehicles.

Other aspects of this approach included immersive tech and the metaverse, which NTT Docomo demonstrated through XR use cases.

Other exhibits linked 6G to specific technologies, such as point-to-point THz communications by Fraunhofer HHI.

NGMN press briefing

During a press briefing, the Next Generation Mobile Networks Alliance (NGMN), discussed their work on fulfilling their vision for 6G. Michael Irizarry, a member of NGMN's board of directors, acknowledged that the industry does not yet fully understand what 6G is, how much it will cost, or what problems it will solve. Nonetheless, he believes that there is a need for organizations like the NGMN to explore the concept of 6G.

Outlook

Operators have yet to deploy the ‘genuine’ 5G, which encompasses standalone mode core networks and many features included in both 5G and 5G Advanced roadmaps. Thus, operators are more focused on monetizing 5G and are not interested in discussing 6G. Vendors are also facing their own issues and are not in a hurry to promote 6G.

Digital Everything them at MWC23. Credit: GSMA.

DIGITAL EVERYTHING

This chapter discusses various technologies, such as edge computing, IoT, AI, and quantum computing, and their applications in sectors like smart mobility in the automotive industry.

At MWC23, experts called for cross-industry collaboration, as smart mobility requires a significant network build-out, and mobile operators may not be willing to fund this infrastructure.

Multi-access edge computing (MEC) is seen as a revenue stream opportunity for mobile operators and was on display at MWC23. However, inter-industry cooperation is necessary as MEC use cases have yet to be proven.

Exhibits of IoT solutions at MWC23 included RedCap solutions from Qualcomm, Rohde & Schwarz, and China Unicom. However, significant revenues from IoT have yet to materialise.

Although AI has become more prominent, with a growing emphasis on generative AI, many AI applications showcased at MWC23, such as network optimization and automation, as well as customer-facing applications, were not new.

Quantum computing poses potential security risks, and the telecommunications industry must prepare for the quantum era.

Smart Mobility Summit at MWC23. Credit: GSMA.

Automotive industry

At MWC23, representatives from GSMA, Toyota, KDDI, and Nexar talked about the state of the connected vehicle services ecosystem.

They noted that the immense technological and financial opportunities of the automotive sector can only be realized with significant network build-out. Indeed, it is estimated that the future connected vehicle services ecosystem will require transfers of up to 10 billion gigabytes of data to the cloud each month, way beyond the capacity of today’s networks.

However, it is unclear whether mobile operators will be willing to fund the associated infrastructure investments.

The speakers underlined the need for cross-industry collaboration to build the network, and suggested actionable steps towards a more connected future.

Edge Computing (MEC)

Multi-access edge computing (MEC) is touted as a revenue stream opportunity for mobile operators.

At MWC23, Edge platforms such as Summit Tech's Odience and NearbyTechnology’s NearbyOne, were on display.

As MEC introduces new IT threats, Mavenir called for industry collaboration and Tata Communications advocates for Mobile Secure Access Service Edge (SASE) and Zero Trust techniques.

Ahead of MWC23, experts gathered at the Mobile Ecosystem Forum (MEF) to discuss the growing interest in the Edge and the commitments made by mobile and fixed-line operators to deploy MEC capabilities.

Yet, Cloud service providers' edge computing needs are primarily driven by data backhaul optimization and regulatory compliance, whereas telecom edge computing is based on low-latency application requirements, posing a higher risk for telecom service providers.

Edge technologies displayed at MWC23

Summit Tech’s Odience platform

For the past three years, Summit Tech has been developing Odience, a cloud-native streaming platform that enables interactive and immersive remote participation experiences through the use of cloud and MEC. Around 23 mobile operators have trialled Odience, and Summit Tech has signed its first commercial agreement with a North American operator. In addition, Summit Tech recently run a 5G MEC trial with the Bridge Alliance, Advanced Info Service (AIS), Singtel and the GSMA.

Nearby Computing’s NearbyOne platform

At MWC23, Nearby Computing showcased how its orchestration platform NearbyOne enables edge computing applications in the government, enterprise, and industry sectors.

MEC security

Mavenir calls for collaboration

According to network software developer Mavenir, the introduction of multi-access edge computing (MEC) brings about IT threats into the operational technology and mission environments, and the wide range of MEC providers “inject different risk postures into networks”.

Mavenir calls for the industry to collaborate on security challenges and to build 5G O-RAN and UE security sustainment into their business models.

“The implementation details of cybersecurity measures will be crucial, as will the effective lifecycle sustainment of internal controls.”

Mobile Secure Access Service Edge (SASE)

Tata Communications advocates for a network edge security approach that follows zero-trust principles and uses Mobile Secure Access Service Edge (SASE) and Zero Trust techniques in combination to protect enterprise endpoints.

The integration of IoT devices into enterprise networks pose security challenges, especially with the advent of 5G, which enables advanced IoT use cases with higher throughput, lower latency, and larger data volumes.

Traditional IT security controls are inadequate for IoT devices because they are often transient, have limited processing power and storage, and may use proprietary operating systems.

There is a need to protect vulnerable API endpoints and gateways by embedding private, zero-trust capabilities in API client and publisher endpoints.

Finally, CIOs must adopt a comprehensive security strategy that combines Mobile SASE and Zero Trust techniques to protect their enterprise endpoints from cyberattacks in a rapidly-changing technological landscape.

Edge computing outlook

Edge talk at the MEF Global Forum

At The Mobile Ecosystem Forum (MEF), ahead of MWC23, experts discussed how mobile operators can monetise the mobile network edge with the deployment of multi-access edge computing (MEC) capabilities. The speakers noted that:

Mobile and fixed-line operators have made significant commitments to deploy MEC capabilities, and there is growing interest in the technology.

Use cases have requirements for both local and cloud compute.

Our view

The edge computing needs of cloud service providers are mainly driven by requirements for data backhaul optimization and regulatory compliance for data localization, privacy, and security. While latency is an important factor, it is not the only consideration. As a result, the business case for developing Cloud edge cloud is more predictable than telecom edge.

In contrast, telecom edge, particularly for mobile operators, is largely based on low-latency application requirements. However, many of these applications are still in their early stages of development or proving their market viability, increasing the risk for telecom service providers who are partnering with Cloud providers to address the edge opportunity.

To ensure the success of edge data centres, it is crucial to conduct careful technical due diligence on the connectivity architecture. Business due diligence should also consider the evolutionary stage of the applications that will run on edge data centres.

Internet of Things

IoT Exhibits at MWC23

RedCap solutions from companies such as Qualcomm (baseband chipset), Rohde & Schwarz (test equipment), and China Unicom (modules), were showcased at MWC23.

Outlook

In previous years, the exhibition floor of the Mobile World Congress was filled with various industrial devices and personal gadgets. However, IoT now seems to have reached a plateau in terms of productivity with only a selective deployment and incremental evolution. The revenue generated by IoT operators remains disappointingly low, and while NB-IoT has been successful in China, it hasn't been matched in other parts of the world.

AI

Overview

Artificial Intelligence (AI) has recently captured the public's attention thanks to advancements in natural language generators and image generators.

AI was a prominent topic at MWC23 and was pitched by both vendors and service providers.

Many of the AI use cases presented were repackaged versions of past applications, including network optimization, intelligent diagnostics, network automation, and other operational and customer-facing applications. Their objective is to enhance the quality of experience and offer more personalized and relevant services, and thus to reduce churn and increase average revenue per user (ARPU).

The Generative AI theme was also prevalent, with chipset vendors showcasing their performance compared to benchmarks.

In this section, we will describe several MWC23 exhibits featuring AI technology, including:

The latest insight solutions from Nokia, Microsoft Google, and Amdocs.

The next-generation OpenBeam mMIMO 32TRX AAU, from Qualcomm and Mavenir, which uses AI-based technology to improve energy efficiency and network performance.

SK Telecom’s intelligent network that improves performance using AI and cloud technologies.

Samsung’s S23 Ultra phone and its AI-powered camera.

We will also cover the talks of:

• Intel’s Cristina Rodriguez, who stated that incorporating AI into virtualized 5G radio networks enables dynamic hardware allocation, optimization of resources, and supports SLAs, creating revenue opportunities through network slicing.

• Economist Arun Sundararajan, who highlighted the importance of making responsible corporate and government AI choices in order to avoid that AI-led transformation exacerbates inequality.

Insight solutions showcased at MWC23

Nokia AVA Customer and Mobile Network Insights

Ahead of MWC23, Nokia unveiled AVA Customer and Mobile Network Insights. This cloud-native analytics software solution simplifies the collection and analysis of 5G network data, providing CSPs with cost-effective analytical capabilities. It leverages AI and machine learning tools to enable intelligent and automated decision-making based on data from across 5G networks.

Microsoft Azure Operator Insights

Ahead of MWC23, Microsoft released a public preview of Azure Operator Insights, which collects and analyses vast amounts of network data from complex multi-part or multi-vendor network functions. This service provides insights for operator-specific workloads to help operators understand the health of their networks and the quality of their subscribers' experiences.

Google Telecom Subscriber Insights

At MWC23, Google Cloud introduced Telecom Subscriber Insights. This service helps mobile operators accelerate subscriber growth, engagement, and retention by utilising insights from existing permissible data sources such as usage records, subscriber plan/billing information, customer relationship management, and app usage statistics.

Amdocs Intelligent Customer Engagement Platform

At MWC23, Amdocs and Microsoft announced the Intelligent Customer Engagement Platform, which will enable cross-domain data input to drive insight-driven recommendations. This platform will be integrated with Amdocs’ end-to-end set of solutions, from customer experience to monetization products to network automation, and will leverage the capabilities of Dynamics 365, the Microsoft Power Platform, and the Microsoft Cloud.

Other MWC23 exhibits featuring AI

Qualcomm’s next generation OpenBeam

Mavenir and Qualcomm announced the launch of their next-generation OpenBeam massive MIMO (mMIMO) 32TRX Active Antenna Unit (AAU), powered by the Qualcomm QRU100 5G RAN Platform. The solution, designed to meet the growing demand for highly efficient and high-performance networks, uses AI-based technology to boost energy efficiency and network performance, helping operators simplify and lower the total cost of ownership of 5G deployments.

Qualcomm also demonstrated its "Stable Diffusion" AI models running on their smartphone chipsets and mapping them to new applications that will eventually run on smartphones.

SK Telecom’s intelligent network

During the congress, SKT displayed ten AI technologies and services, including an AI model called "A," the AI semiconductor "SAPEON," "Vision AI" for various industries, location AI solution "LITMUS," and medical AI service "X Caliber."

SKT also exhibited an intelligent network, which provides improved performance through the application of AI and cloud technologies.

Samsung’s S23 Ultra phone

The Samsung S23 Ultra boasts one of the largest zoom ranges available commercially, with a capability of up to 100x. The phone’s camera uses AI technology to capture details with great precision. Samsung’s stand at MWC23 displayed a miniature set that allowed visitors to test the camera.

Wayra Telefonica

At 4YFN, the startup event of MWC Barcelona, Wayra Telefonica held a pitch event during which their top 4 startups presented their disruptive business models leveraging AI.

MWC23 AI debates

Intel’s AI use cases

According to Cristina Rodriguez, VP and GM of Wireless Access Networking Division at Intel, incorporating AI innovations into virtualised 5G radio networks will allow mobile operators to improve network control. Rodriguez stated that AI:

• Enables dynamic hardware allocation in RAN functions and optimization of resources according to demand, thus reduces costs.

• Guarantees throughput, latency and reliability, thus supports Service Level Agreements (SLAs) and creates revenue opportunities through network slicing

The Economics of Artificial Intelligence

During his talk at MWC23, the economist Arun Sundararajan, described the economic forces underpinning the AI-led transformation. He also highlighted the importance of responsible corporate AI choices and effective AI regulation. Sundararajan stated that “the choices that businesses and governments make this decade will define whether AI raises global standards of living or exacerbates growing global inequality”.

Quantum Security

Security was a critical topic at MWC23, as the adoption of open networks, edge computing, IoT and quantum brings about new IT threats. In this section, we will focus on Quantum security, as we have covered other security topics elsewhere.

Post-Quantum Telecom Industry Seminar

The GSMA facilitated the first ever seminar on post-quantum security for telecom operators.

Lory Thorpe, Industry Partner for Telco Transformation Consulting at IBM, warned that although cryptographically relevant quantum computers do not currently exist, they will eventually present potential security risks to the legacy systems and encryption methods employed to safeguard networks and customer data.

Thus, developments in quantum cryptography have disruptive potential for the entire telecom supply chain, especially given the on-going global tensions that make communication and data security paramount. Moreover, securing IoT devices, which have a long lifespan, will require several years of continuous effort.

Hence, Thorpe called for the telecommunications industry to begin planning for the shift to post-quantum cryptography and to get ready for the quantum era.

Quantum Exhibits

SK Telekom

SK Telecom showcased a chip that combines a quantum random number generation function with a cryptographic communication function, along with other security solutions from major semiconductor companies like Marvell and startups focusing on key distribution and data encryption.

Marvell

Other security solutions were also on display from large semiconductor companies like Marvell as well as startups addressing key distribution and data encryption at rest or in motion.

Credit: GSMA

REALITY+

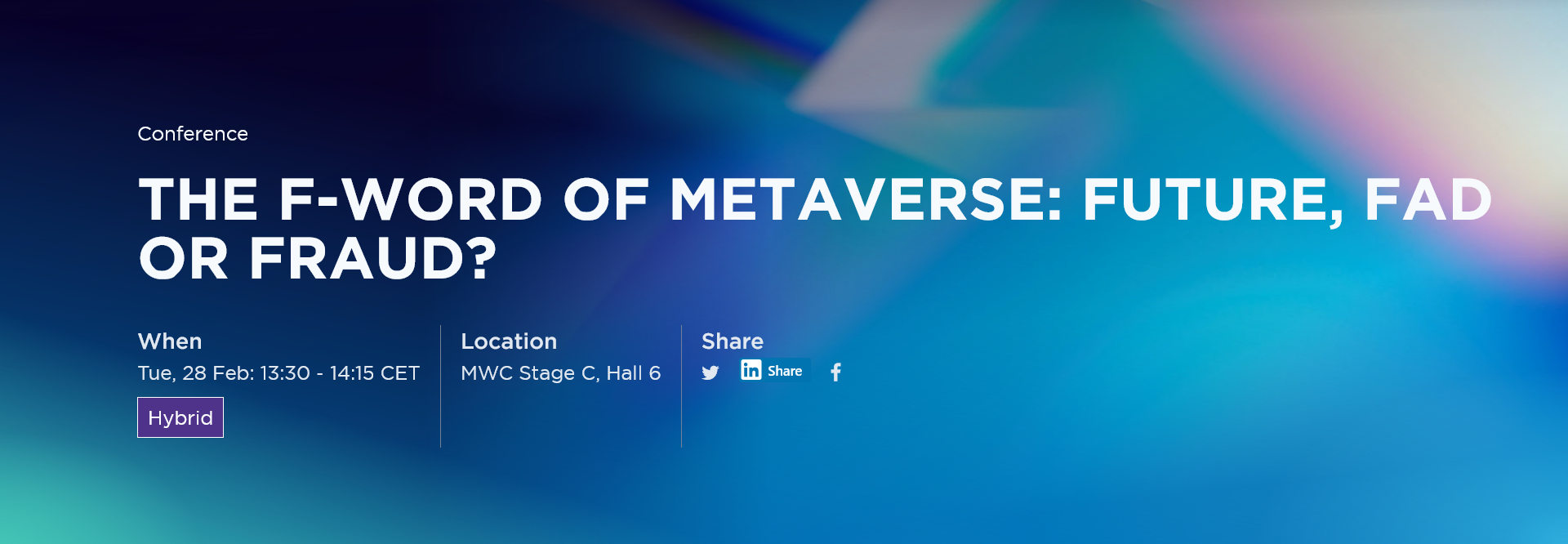

This chapter explores the Metaverse (Reality+), a major theme at MWC23, together with its applications in the Gaming industry.

While the Metaverse was still highly promoted at the Congress, experts were cautious about its potential in the short term. However, gaming is one industry already undergoing changes, through the use of technologies such as 5G, cloud/edge computing, blockchain, and AI.

MWC23 showcased various exhibits, including Matsuko’s real-time holographic calling app, Orange’s 5G immersive entertainment experiences, and Vodafone and Ericsson’s cloud gaming/esports.

Metaverse

In this section, we discuss the scepticism that the Metaverse faced at the recent MWC23 event, with experts being cautious about its potential and targeting 2030 as a possible timeframe. Additionally, we present the demonstrations that were showcased at MWC23, including Matsuko's Real-Time Holographic Calling App, Orange's 5G Tech Using Immersive Experience, Verizon Business' Immersive 5G Experiences, and the emphasis on smaller headsets by Qualcomm, HTC, and Xiaomi.

Timeline

Facebook's rebranding as Meta and its investment of $100 billion on the development of the metaverse have not resulted in significant growth, leading to the company's recent layoff of 11,000 employees as Reality Labs, Meta’s metaverse division, suffered $13.72bn in 2022. At the time of MWC23, Meta’s share price was trading at 51% below its September 2021 peak.

This context perhaps explained the scepticism that the Metaverse faced at MWC23. Although Reality+ was a major theme, experts were more cautious about its potential compared to the previous year. Use cases were unclear and the prevailing sentiment was that the concept is still years away, with many targeting 2030 as a possible timeframe.

Leslie Shannon, Nokia’s head of ecosystem and trend scouting, likened today's metaverse to that of the internet in 1993: “We are at a point where we can see that there is something here, but we are not really sure what it is. We have to build the infrastructure. Because once the infrastructure is in place, that is when the creatives can come in and show us what this thing is really for.”

MWC23 Demonstrations

Matsuko’s Real-Time Holographic Calling App

Matsuko, which offers a software-only solution for real-time holographic calls, launched app upgrades that will enhance resolution, framerate, latency, and bandwidth. These upgrades will use the 5G network API provided by Deutsche Telekom and Orange.

Earlier in January 2013, Matsuko, along with T-Mobile US, Deutsche Telekom, and Orange, successfully tested the efficacy of the network by organizing the first real-time transatlantic holographic call. They are now collaborating on making the service interoperable with various devices like smartphones and mixed-reality glasses.

Orange’s 5G Tech Using Immersive Experience

Orange showcased immersive experiences, focusing on 5G benefits in sectors such as sports and entertainment.

One experience, called "Immersive Run," allowed visitors to simulate running a marathon in Paris using a 360-degree screen, 30-m2 dome, spatial audio system, and photogrammetry.

Orange also unveiled a tablet designed with Touch2See that allows blind or visually impaired people to experience sporting events by following the movements of a ball using a magnetic disc and real-time data processing from the French Football League and Stats Perform's AI cameras.

Verizon Business’ Immersive 5G Experiences

Verizon Business demonstrated its immersive 5G solutions, including:

Verizon’s mobile edge computing (MEC) solution for warehouses,

Coach-to-coach communications used at NFL stadiums, and

An interactive cityscape to “demonstrate the interconnectedness of 5G networks and solutions”.

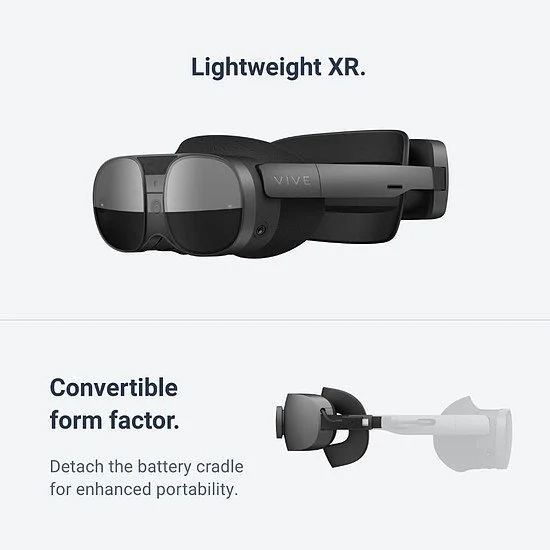

Smaller headsets

Qualcomm emphasized the need for less bulky headsets to unlock the metaverse and extended reality (XR), while both HTC and Xiaomi unveiled smaller headsets at the event.

For instance, HTC's Vive XR Elite, which can be used for both AR and VR experiences, weighs just 625 grams, nearly 100 grams lighter than Meta's Quest Pro.

Meanwhile, Xiaomi's Wireless AR Glass weighs a mere 4.4 ounces and offers AR capabilities on the go.

Vive XR Elite, Credit: HTC

Gaming

This section presents the MWC23 exhibits by Vodafone and Ericsson, where they demonstrated cloud gaming and esports using 5G technology, as well as the evolution of gaming, including the impact of 5G, cloud/edge computing, blockchain, AI, and the Metaverse.

MWC23 exhibits

Vodafone and Ericsson demonstrate cloud gaming/esports

Vodafone and Ericsson continue to explore and promote different avenues for 5G monetisation, following the inauguration of Vodafone 5G Lab in 2021.

Visitors to Ericsson's stand at MWC and Vodafone's 5G Lab in Madrid were able to participate in an augmented reality game called HADO using a high-performance 5G network.

The demonstration showcased three key ingredients for 5G monetisation, including 5G Standalone, Network Slicing, and Exposure.

The evolution of gaming

Mobile devices are driving the democratization of gaming, particularly among the younger "mobile-first" generation and even the older "boomer" generation. This has led to the popularity of hypercasual games, which are easy to play and often free.

The gaming industry is undergoing significant changes also because of the emergence of new technologies such as 5G, cloud/edge computing, blockchain, and AI. As the video streaming market reaches saturation, gaming is becoming a new area of growth, with changing gamer behaviours and new business models such as mobile gaming, gaming subscriptions, and live gaming. Cloud-based gaming subscriptions are number one, followed by consoles, then game publishers. 5G networks are providing fast speeds, high capacity, and low latency capabilities for multiplayer gaming outside the home. The use of emerging technologies like AI and blockchain is increasing in gaming, and the metaverse is impacting various aspects of gaming, including game content, development, business models, advertising, privacy, and security.

Credit: GSMA

KEY TAKEAWAYS

Open Networks

It is worth watching the initiative of operators banding together to offer Open Gateway APIs to developers, but gaining adoption remains a key challenge. Previous similar initiatives have failed in the past, and doubts remain about its potential success despite the hope that 5G networks and support from Hyperscalers like AWS and Cloud will make a difference.

Open RAN was expected to bring flexibility to networks and challenge major equipment suppliers' dominance, but deployment and are challenging. The market may still end up being dominated by traditional equipment vendors, and the only clear opportunity for Open RAN players is with new-build networks.

Despite promises of open and virtualized radio access network solutions, their adoption is yet to pay off in the service provider sector.

eSIMs have the potential to offer significant benefits to end-users but may come at the expense of established operators.

5G Acceleration

5G Private Enterprise Networks are seen as a potential source of additional revenue for operators and vendors, but proven use cases are still pending.

Additional spectrum is crucial to drive the capabilities of the second wave of 5G.

Operators are more focused on monetizing 5G than discussing 6G, and vendors are facing their own issues and not in a hurry to promote 6G.

Digital Everything

Smart mobility requires a significant network build-out, and mobile operators may not be willing to fund this infrastructure.

Multi-access edge computing (MEC) is a revenue stream opportunity for mobile operators, but inter-industry cooperation is necessary as MEC use cases have yet to be proven.

Significant revenues from IoT have yet to materialize, and many AI applications showcased at MWC23 were not new. Quantum computing poses potential security risks, and the telecommunications industry must prepare for the quantum era.

Reality+

The Metaverse faces scepticism and 2030 is a likely timeframe. While MWC23 featured demonstrations of XR solutions, they were no longer considered novel.

Gaming is undergoing changes, through the use of technologies such as 5G, cloud/edge computing, blockchain, and AI.

FinTech

Web3.0 and blockchain applications were showcased at MWC23, but have been affected by the ongoing crypto winter. We chose not to cover these topics in this article.

Should you be interested in finding out more about the key topics of MWC23, follow this link to download the various insight notes from our Xona Partners colleagues, including:

MWC23: Velocity or Suspended Animation?

How Mobile Network Operators Really View Open RAN

Enabling Direct-to-Handset Satellite Connectivity: Highlights from the Proposed FCC Regulations

Apple-Globalstar: Just an SOS or Birth of the "Global" Telco?

Synergies between LEO Satellite Constellations and Submarine Cables

Can 5G Bridge the Urban-Rural Digital Divide?

Optimizing Rural Broadband Techno-Economic Trade-offs

Planning Automation for Rural and Remote FTTH Networks

Dispelling the Myth of Sustainability in 5G Mobile Networks: What’s Worth The Investment?

Millimeter Wave Has Failed. Or Has It Really?

Edge Computing: Has the Edge Turned Dull?

Internet of Things: Where Are We At?